CBQ mPOS app for iPhone and iPad

Developer: Commercialbank of Qatar

First release : 18 May 2015

App size: 2.56 Mb

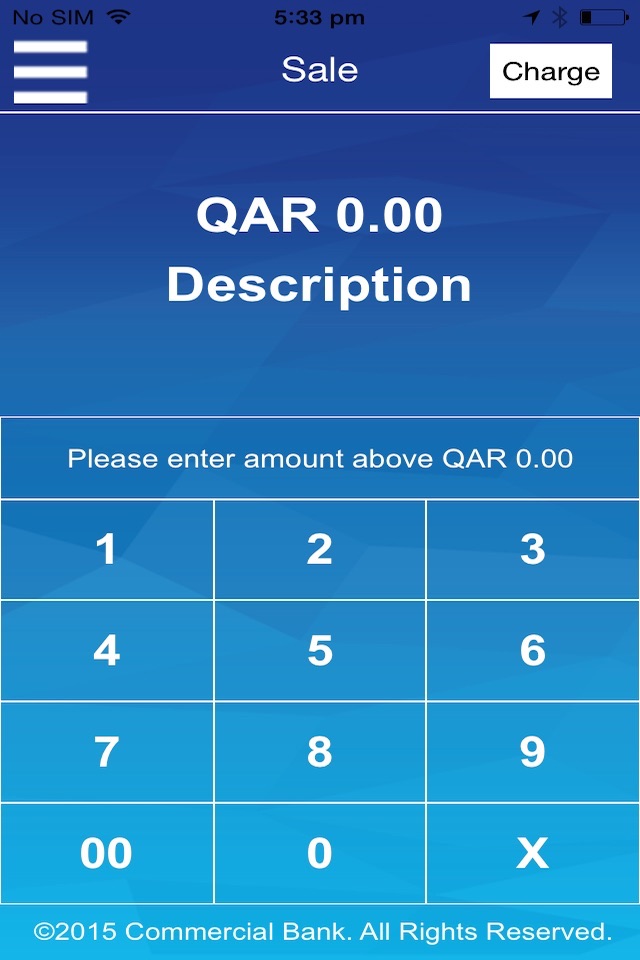

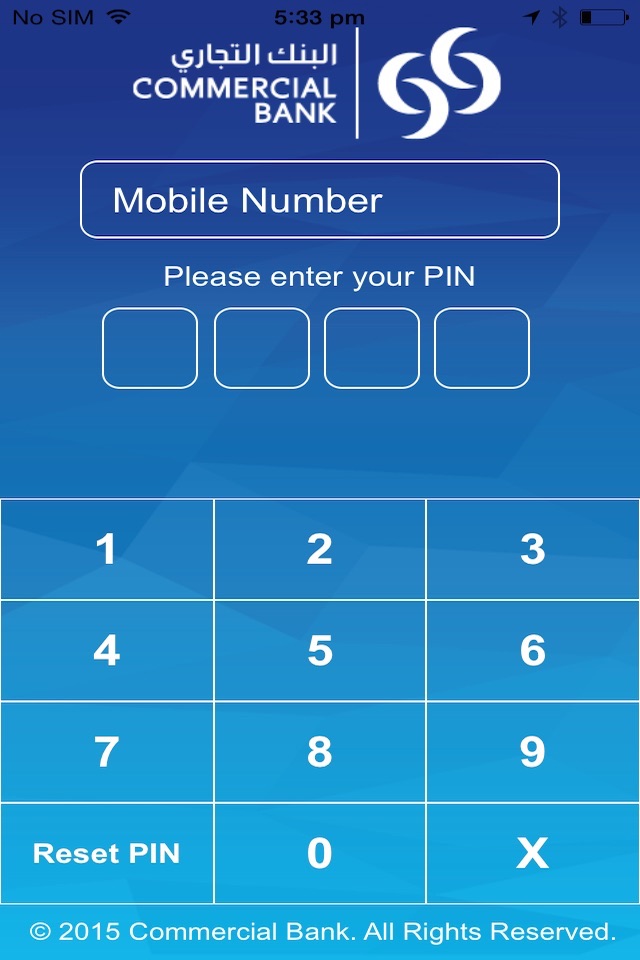

Commercial Bank mPOS is a new solution designed for merchants, allowing them to use their mobile phones as a Point of Sale device to accept Debit and Credit Card transactions. mPOS transforms mobile phones into a highly secure card acceptance device using a Commercial Bank mPOS application and a pocket-sized device that facilitates Chip & Pin transactions.

Commercial Bank’s mPOS solution also provides a merchant portal for online control of payments and reporting. By using mPOS, not only can merchants increase customer loyalty by accepting a wider range of payments but they can do so cost effectively, thereby lowering the cost of cash handling and the cost of expanding their terminal network.

Key Benefits to Merchants

Grow your business

Accept card payments whenever and wherever you are and grow your business

You can increase volumes, securely, and offer clients payment choices

Drive sales in different parts of your store.

You can sell to customers anywhere in your store using mPOS in new ways. Hold an in-store demonstration to promote a product or service and then close the deal when your customers are excited and ready to buy.

Increase convenience

For our merchants convenience, we provide digital receipts that can be shared with card holders via e-mail or SMS and can be easily retrieved using our merchant portal to meet your customer’s needs.

Reduce Fraud

Now your card transactions are always processed real-time, reducing fraud resulting from batch or off-line transactions

Mirroring traditional POS

mPOS transactions allow all types of traditional POS functionality including .e.g. Tips and receipting

Integrated Applications

CBQ’s mPOS solution allows you to link your own applications and inventory management systems to the mPOS application so payment is seamless

Get Started with mPOS

• Contact your Merchant Account Manager and get your mPOS card reader

• Down load CBQmPOS application from Play Store

• Follow the setup instructions provided and connect the mPOS card reader to your smart phone.

• Sign in with provided credentials and start accepting secure payments anywhere and at any time.